December 23, 2013 – After a devastating warehouse fire destroyed many of its permanent sets, props and costumes this past May, the Syracuse City Ballet (SCB) is back to performing family-friendly entertainment, thanks in large part to an outpouring of community support that helped offset replacement costs not covered by insurance. Now SCB is receiving an additional boost from the Central New York Community Foundation to replace more of its valuable sets and costumes.

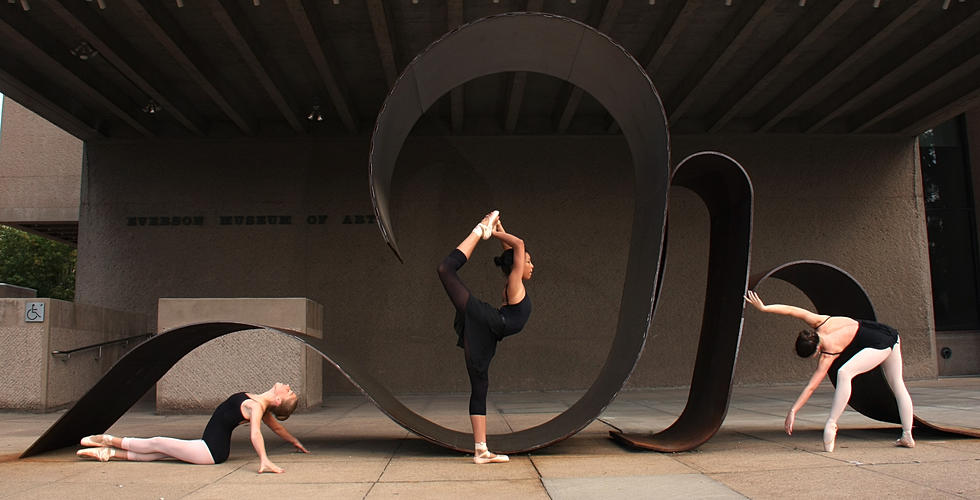

Photo courtesy syracusecityballet.com.

The Community Foundation awarded SCB a $20,000 grant to support the purchase of sets and costumes for its future production of Cinderella. Because of their permanent nature, the items will be able to be repurposed for future productions.

Cinderella, which SCB will perform at the Crouse Hinds Theater (Oncenter) for audiences in March 2014, will also involve a unique partnership with The Corning Museum of Glass. Representatives from the Museum will be conducting a glass-blowing demonstration to create Cinderella’s glass slipper at one of the performances, to be raffled off at the conclusion of the show. There will be 45 local youth and professional dancers involved in the production.

“This project will renew our efforts to build New York audience enchantment with the classical art of ballet,” said Harriet Casey, Ballet Assistant Director. “A strong audience base will bring new energy, funding sources, and sustainability to SCB. In addition, we look forward to continuing our work with local schools and nonprofit organizations that work for the well-being of children.”

The Community Foundation also awarded additional grants to programs in the fields of arts & culture, education, environment, health, human services and civic affairs:

ACR Health received $13,473 to provide youth leadership training through the Q Center,, which will allow participants to explore their strengths and encourage them to take part in in creating a more supportive community for LGBTQ youth.

The American Heart Association Greater Syracuse Division received $25,000 to implement two awareness-building programs: 1) Go Red Por Tu Corazon, which empowers Latina women to take action against heart disease, and 2) Check. Change. Control., an education program for African American women that focuses on the importance of blood pressure self-monitoring.

The Cathedral of Immaculate Conception received $20,000 to purchase dental equipment and a portable x-ray machine that will allow its Amaus Health Services program to provide primary dental care to uninsured and underinsured patients.

The Cazenovia Preservation Foundation received $43,500 to complete structural and aesthetic enhancements to an integrated pond and wetland ecosystem in the Village of Cazenovia.

Christian Health Service of Syracuse received $22,500 to increase access to quality, affordable primary care for Medicaid patients by adding one mid-level health care provider to its clinic.

The CNY Regional Planning & Development Board received $15,000 to develop curriculum and purchase materials to introduce the Energy Challenge program in middle school classrooms. The program will offer hands-on learning experiences that promote energy-saving techniques for school and home.

Community Resources for Independent Seniors received $7,000 to implement a time-banking system that allows community members to log volunteer time to exchange for other volunteer-driven services in the future.

ENABLE/TLS received $20,000 to purchase an upgraded server and other technology that will better handle the load of the agency’s combined staff following its recent merger.

The Everson Museum of Art received $53,000 for educational programming and access for local school children in association with the Heaven and Earth exhibit, featuring major works of art from the Italian Renaissance and Baroque periods, along with related educational programming.

Faith and Hope Community Center received $5,000 to purchase new equipment for its fitness and boxing programs.

First Tee of Syracuse received $20,000 to purchase a passenger van that will transport children from community centers and schools to golf courses for character development programming.

Good Life Foundation received $15,000 to establish a life coaching program that will work with high-risk youth to develop a life plan through coaching, financial literacy and entrepreneurial opportunities.

Le Moyne College, in partnership with the New York Family Business Center, received $20,000 to develop programming and curriculum that benefits the local family business community through professional development and support.

Chestnut Hill Elementary School received $7,000 to purchase new playground equipment.

Multicultural Association of Medical Interpreters (MAMI) received $14,260 to provide a training course to its court interpreters preparing for the New York State Court English Language Proficiency Exam.

Meals on Wheels/FM-JD received $3,534 to install an automatic door to ease loading and unloading of delivery vehicles.

Ophelia’s Place received $11,200 to install a new HVAC system at its Liverpool location, where it provides outreach, support and advocacy for those impacted by eating disorders.

Salvation Army of Syracuse received $29,000 to train its staff on trauma-informed care, which will help shelter workers to address the problems homeless clients have faced, such as abuse, neglect, illness or domestic violence.

St. Camillus Health and Rehabilitation Center received $23,276 to relocate and enhance its resident gathering space, used by its physical rehabilitation patients for activities, parties and family visits.

Syracuse Parks Conservancy received $18,200 to operate a grants program that will fund beautification improvements in Syracuse neighborhoods and parks.

Syracuse Stage received $25,000 to purchase an upgraded digital sound console that will enhance audience experience by improving the quality and consistency of sound during its productions.

VNA Homecare received $40,000 to expand its Care Transitions Program, which promotes a seamless transition for hospital patients when returning home to prevent further complications.

These grants were funded by the Community Foundation’s unrestricted and field-of-interest funds.

About the Central New York Community Foundation

Established in 1927, the Central New York Community Foundation encourages local philanthropy by supporting the growth of a permanent charitable endowment for the betterment of the region. The Community Foundation is the largest charitable foundation in the region with assets of more than $143 million. It awarded $8.3 million in grants last year to nonprofit organizations and since its inception has invested more than $120 million in the community. The Community Foundation serves as the steward of charitable legacies for individuals, families and corporations through the administration of more than 600 funds. The organization also serves as a civic leader, convener and sponsor of special initiatives designed to strengthen nonprofits that address the region’s most pressing challenges. For more information, visit www.cnycf.org.

###